In case your financial debt circumstance is beginning to get frustrating but you're still effective at generating payments, a financial debt consolidation loan could assistance. With very good or exceptional credit, you may be able to qualify for your decreased curiosity level on the new bank loan than Whatever you're at this time paying out on your own credit card debt.

Also, before you cease producing payments on your credit card debt, make certain you qualify for bankruptcy. Costs quickly mount after you quit, and if you don’t file, it might be hard to convey your accounts current.

Open up a fresh line of credit. After a while has handed and you're feeling fiscally steady, consider opening a fresh line of credit which has a reliable lender to reestablish healthy credit behaviors.

World-wide Credit Developments Explore global credit and economic information insights. Offering tendencies in credit danger, debt, utilization and delinquencies from worldwide.

When you established monthly investing goals and track your fees, You might also be able to start out developing an crisis fund and dealing towards other personal savings ambitions to provide more balance towards your economical plan.

It's important to notice that each delinquent account included in the individual bankruptcy may also stay on the credit report for approximately seven several years. Though the 7-calendar year clock for delinquent accounts commences whenever they had been to start with claimed as late, not after you filed for personal bankruptcy.

Should you be contemplating filing Chapter thirteen simply because you don't go the means examination, check out The explanations you aren't passing.

Most often, this will be a little personalized loan. You can use The cash you get for everything – residence repairs, building essential purchases, or many people even get out loans and divert the money to an expense.

Not sure where by to begin? Choose our swift merchandise finder quiz to discover an item that assists fulfill your preferences.

The aim of bankruptcy is usually to wipe Visit Website out individual liability for personal debt. Which aim is effectively within reach. In the case of Chapter 7 filings, the good results price for discharging unsecured debts (like credit cards) is undoubtedly an astounding ninety six.eight% but you will discover important negatives to contemplate before filing.

The standing of accounts A part of your Chapter thirteen repayment strategy may or may not be mirrored as address part click site of your credit report: Creditors usually are not obligated to report payments acquired in the course of the Chapter thirteen repayment interval, but some do.

Even though article bankruptcies drop off your credit report 7 to 10 years after you initially submitted, your credit score will go on to suffer until then. Nevertheless, you usually takes steps to rebuild your credit in the meantime.

Except if you have completed all the earlier mentioned, not spending your credit card bills could set you inside a even worse fiscal posture. Learn about these as well as other concerns.

Other merchandise and business names outlined herein will be Resources the assets of their respective homeowners. Licenses and Disclosures.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Edward Furlong Then & Now!

Edward Furlong Then & Now! Luke Perry Then & Now!

Luke Perry Then & Now! Jenna Von Oy Then & Now!

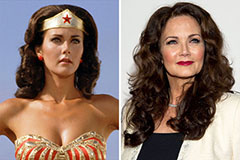

Jenna Von Oy Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now!